Who needs the Employment Verification Form?

The Federal and State Low-Income Housing Tax Credit Laws require the project owners to certify tenant incomes on an annual basis in conformance with IRS regulation §1.42-5(c)(3) provided that the project is not a 100 percent (100%) tax credit property exempted under IRC Section 142(d)(3)(A). Owners of a 100% tax credit property have to perform a first annual income recertification in addition to the initial move-in certification. After initial move-in certification and first annual recertification, owners of 100% tax credit properties may discontinue obtaining income verifications.

To comply with the aforesaid requirement, the project owner requests an applicant’s or tenant’s employer to complete the employment verification form.

What is the purpose of the Employment Verification Form?

The purpose of the form is to verify income of an applicant/tenant of a housing program.

Does the Employment Verification Form have a validity period?

The form’s validity period is 12 months.

What information should be provided?

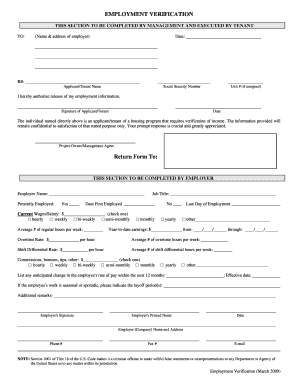

The form consists of two sections. The project owner or management agent completes the first section; the tenant signs it thus authorizing release of his employment information. Having completed the first section, the owner or manager sends the form to the tenant’s employer.

The employer completes the second section providing the following information:

- employee’s name;

- job title;

- current wages/salary;

- average number of regular hours per week;

- average of overtime hours per week;

- overtime rate;

- average number of shift differential hours per week;

- shift differential rate;

- commissions, bonuses, tips;

- anticipated change in the employee’s rate of pay within next 12 months;

- employer’s name, address, phone, fax and e-mail.

Where do I send the Employment Verification Form?

The employer returns the form to the project owner or management agent.